Vietoj 3, 4 ir 5 užduoties galima pasirinkti daryti vieną iš šių (bet vis tiek bus du atsiskaitymai - tarpinis ir galutinis):

- Martingalo strategija.

Would you be interested in a trading strategy that is virtually 100% profitable? Amazingly, such a strategy exists and dates all the way back to the 18th century. The martingale strategy is based on probability theory, and if your pockets are deep enough, it has a near-100% success rate. https://www.investopedia.com/articles/forex/06/martingale.asp

Prieš išgarsėdamas kaip didžiausios kriptovaliutų fermos Baltijos šalyse įkūrėjas, Paulius Aršauskas su partneriu Arminu Gužausku užsiėmė ir kitomis veiklomis. Viena tokių – prekyba „Forex“ valiutų rinkose – jiems pridarė šiek tiek problemų. Šiuo metu teisėsauga atlieka ikiteisminį tyrimą, kur abiem vaikinams suteiktas specialiojo liudytojo statusas.

Turbūt martingalas: https://www.copyfx.com/ratings/rating-all/show/41011/tab/profit/period/all/

- Pensijų fondų performace

Paimti kelis populiarius lietuviškus pensijinius fondus, kurie 100% investuoja į akcijas. Patikrinti, ar jie prekiauja geriau, nei rinka. Sukurti algoritmą, kuris aplenks lietuviškų pensijinių fondų rezultatus (neturėtų tai būti sunku padaryti :) )

- Time based trading strategy

The Friday Gold Rush https://www.whselfinvest.com/en-lu/trading-platform/free-trading-strategies/tradingsystem/59-friday-gold-rush-andre-stagge-free

Po visos dienos kilimo likus valandai iki uždarymo parduodam į skolą (sell short) tikintis, kad daug kas nusiims pelnus ir numuš kainą.

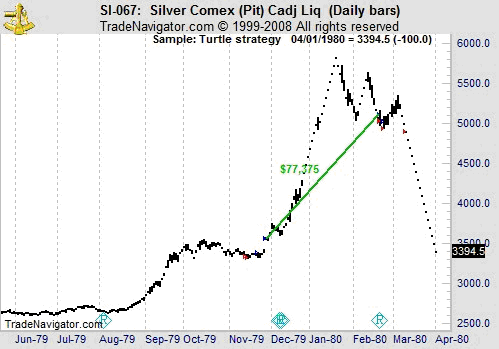

- Turtles strategija

The turtles became one of the most famous experiments in financial history because they ended up generating returns in excess of an 80 percent compounded rate over the next four years. Dennis had demonstrated that traders could be taught a relatively simple set of rules with little or no trading experience and become excellent traders. https://www.investopedia.com/terms/t/turtle.asp

https://www.amazon.com/Way-Turtle-Methods-Ordinary-Legendary/dp/007148664X

Richard Dennis made over $200 million as a trader.[6] After having a debate with his partner, William Eckhardt, about whether trading is learnable or an inborn talent, they proposed an experiment where they would spend two weeks training novices in the science of trading and then give them each $1 million to invest.[5] The inspiration came from a trip Dennis took to a turtle-breeding farm in Singapore, stating, “We are going to grow traders just like they grow turtles.”[7]

Although each of the 1,000 applicants went through a rigorous application process designed to test their intelligence, ability to manage risk and mathematical skills, the makeup of the chosen Turtles differed greatly; they included a Czechoslovakian-born blackjack master, a Dungeons and Dragons game designer, an evangelical accountant, a Harvard MBA, a U.S. Air Force pilot and a former pianist.[1] The Turtles would go on to gross over $150 million in four years.[8][9] https://en.wikipedia.org/wiki/The_Complete_TurtleTrader

- Scalping strategija

Scalpers seek to profit from small market movements, taking advantage of a ticker tape that never stands still during the market day. https://www.investopedia.com/articles/active-trading/012815/top-technical-indicators-scalping-trading-strategy.asp

Pvz: Naudojant tick duomenis lauki kada kaina nukris per x ir perki tikinti, kad atkils. Prekyba vyksta dideliu dažnumu - nuo kelių sekundžių iki keliasdešimt minučių. Tikiesi, kad kaina trumpu laikotarpiu juda random aukštyn žemyn ir stengiesi uždirbti iš šių smulkių judesių.

- Akcijų indekso sudedamųjų akcijų prekyba

Paimi akcijų indeksą pvz S&P 500. Iš tų 500 akcijų išsirenki 10 pagal tam tikrą kriterijų atrodančių geriausiai. Ir tas 10 perki ir laikai metus. Gal bus geriau, nei pirkti visą S&P 500 indeksą?

https://investorplace.com/2018/09/15-best-sp-500-stocks-for-the-rest-of-2018/

- Pair trading

The trader should look for the divergence pairs that have moved away from each other and and then back together in a regular pattern.

Surandi akcijų porą, kuri turi judėti panašiai, pvz BP ir XOM akcijos. Abi yra didelės naftos gavybos įmonės.

- Kriptovaliutų arbitražas

Duomenys https://api.bitcoincharts.com/v1/csv/

Laikas suformatuotas unix laiku. The unix time stamp is a way to track time as a running total of seconds. This count starts at the Unix Epoch on January 1st, 1970 at UTC. Therefore, the unix time stamp is merely the number of seconds between a particular date and the Unix Epoch. https://www.unixtimestamp.com/

Paimi kelis bitcoin duomenis iš skirtingų biržų. Jei vienoje biržoje kaina pigesnė, nei kitoje, tai greitai perki ten kur pigu ir parduodi ten, kur brangu.

The idea is to buy cheap on exchange A, transfer to the exchange B where you can sell for more and sell. At the end to go through the full circle, send what you’ve received for the transaction from exchange B to exchange A. Repeat… https://medium.com/coinmonks/cryptocurrency-arbitrage-strategies-part-i-20e9dd327919

https://coin.market/arbitrage.php

https://coin.market/arbitrage.php

- Event driven strategija

Kai Juventus pralaimėjo pirmas čempionų lygos aštunfinalio rungtynes 0-2 akcijos labai krito, nes buvo didelė tikimybė, jog nepateks į sekantį etapą ir nagaus daug pajamų. Tačiau antras laimėjo 3-0 ir atšoko atgal.

The club’s share price rose as much as 30 per cent from a Tuesday close of €1.22 to a high of €1.59 in Milan in early Wednesday trading — boosting its market capitalisation by €373m to €1.6bn. https://www.ft.com/content/329573b0-457f-11e9-b168-96a37d002cd3

Panašiai su Amsterdamo Ajax, kai išmetė Madrid Real

MANU akcijos prekiaujamos NYSE

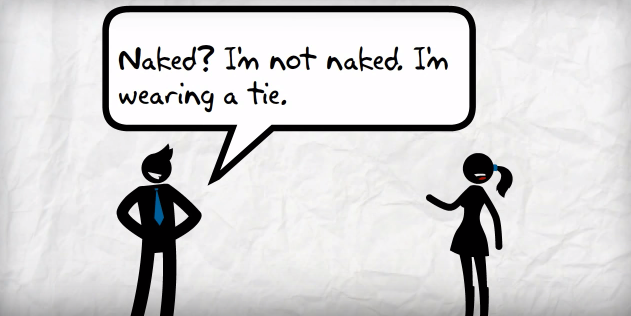

- Naked options writing

When it comes to options trading, it doesn’t get much sexier than playing it naked. No, I’m not referring to what you wear (or don’t) when you’re sitting in front of your computer trading (that’s your business alone). I’m talking about naked options writing. https://investorplace.com/2011/08/writing-naked-options/

Writing an option is a fundamental investment strategy dating back to ancient times in which an investor seeks to make money by correctly predicting future price movements in a stock or commodity. For example, a farmer growing corn may believe that current drought conditions will not persist into the next growing season, so he writes call options on the future price of corn. As the buyer of corn options, the farmer is granted the right to buy at a specified price in the future. This type of buy option is known as a call. The seller of an options contract must sell at the specified price, so in this case the farmer hopes to buy low and reap the rewards of the improved growing conditions for commodities once the drought ends. https://www.investopedia.com/terms/w/writing-an-option.asp

OptionSellers fondas užsiminėjo opcionų writinimu ir generavo gerą gražą, bet prastai suvaldė riziką ir ne tik kad prarado 100% visų investuotojų pinigų, bet ir dar investuotojai liko skolingi. Po šio įvykio patalpino į youtube atsiprašymo video “OptionSellers.com / James Cordier - Full apology video” https://www.youtube.com/watch?v=VNYNMM0hXXY

What Is A Naked Put Option? https://www.youtube.com/watch?v=U79T81QRBTw

- Sukurti lietuviškų akcijų portfelį

Iš Nasdaq Baltic biržos paimti duomenis. Bandyti sukurti portfelį. Pažiūrėti, kaip jis pasilygina su Baltijos biržos indeksu.

- Patikrinti, kuris sandorių vykdymo metodas geresnis: limit ar market?

When an investor places an order to buy or sell a stock, there are two fundamental execution options: place the order “at market” or “at limit.” Market orders are transactions meant to execute as quickly as possible at the present or market price. Conversely, a limit order sets the maximum or minimum price at which you are willing to buy or sell.

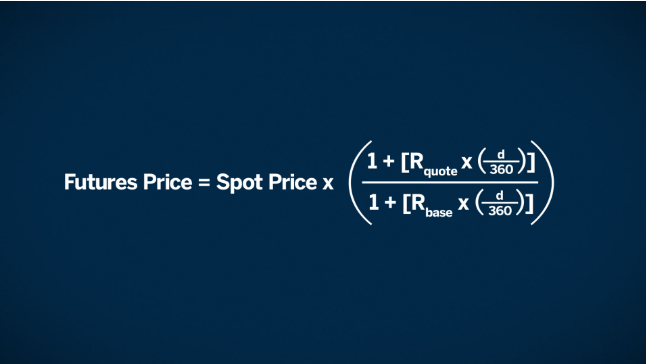

- Interest rates difference

The price of an FX futures product is based on the currency pair’s spot rate and a short-term interest differential. If the short-term interest rate of the terms currency rate is lower than the short-term interest rate of the base currency, futures should trade at a discount to the spot price of the currency pair. The basis (that is, futures minus spot) would be quoted as a negative number. Example: https://www.cmegroup.com/education/courses/introduction-to-fx/importance-of-fx-futures-pricing-and-basis.html

- Any Monkey Can Beat The Market

Give a monkey enough darts and they’ll beat the market. So says a draft article by Research Affiliates highlighting the simulated results of 100 monkeys throwing darts at the stock pages in a newspaper. The average monkey outperformed the index by an average of 1.7 percent per year since 1964. That’s a lot of bananas!

What is all this monkey business? It started in 1973 when Princeton University professor Burton Malkiel claimed in his bestselling book, A Random Walk Down Wall Street, that “A blindfolded monkey throwing darts at a newspaper's financial pages could select a portfolio that would do just as well as one carefully selected by experts.”

“Malkiel was wrong,” stated Rob Arnott, CEO of Research Affiliates, while speaking at the IMN Global Indexing and ETFs conference earlier this month. “The monkeys have done a much better job than both the experts and the stock market.”

https://www.forbes.com/sites/rickferri/2012/12/20/any-monkey-can-beat-the-market/#19c35f75630a